Best Personal Loans in Canada 2025: From Low Interest Rates to Easy Approval

Personal loans in Canada are a common solution for short-term financial needs. Whether it's unexpected expenses, consolidating high-interest debt, home renovations, or covering education or relocation costs, choosing the right lender and product can help reduce financial pressure and manage costs effectively.

This guide presents the best personal loan providers in Canada in 2025, catering to a wide range of credit scores, income levels, and borrowing goals. Whether you have excellent credit or are looking for flexible lending with average credit, suitable options are available.

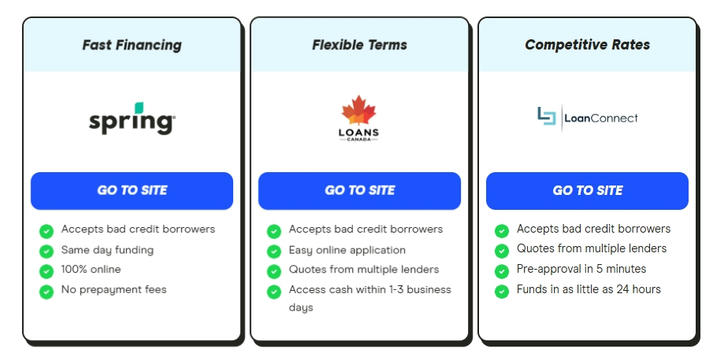

Comparison of Recommended Lenders and Products

1. Spring Financial

Loan amount: $300 – $35,000

Speed: Same-day approval and disbursement

Highlights: No penalties for early repayment

User Reviews: 4.6 out of 5 on Trustpilot (BBB rating: D)

How to apply: Complete a short online application. After submission, a representative will contact the applicant to confirm details and move forward.

Example: A part-time worker needed $3,000 for vehicle repairs. They received same-day approval from Spring Financial without requiring a guarantor.

2. Loans Canada

Loan amount: $250 – $50,000

Platform type: Loan marketplace partnering with over 60 lenders

Suitable for: Both good and average credit borrowers

How to apply: Submit an online form. The system will match the applicant with suitable lenders and rates based on their profile.

Example: A freelancer with a 640 credit score was unable to qualify through a traditional bank. Loans Canada matched them with a lender offering a 13% APR.

3. LoanConnect

Loan amount: $500 – $60,000

Starting interest rate: 8.99% (depends on credit)

Key benefit: Quick pre-approval and matched loan offers

How to apply: Fill out an online form and receive multiple pre-approved offers to compare.

4. AAR Financial

Loan amount: $1,000 – $50,000

Key benefit: Approval rate as high as 99%

Loan options: Unsecured or home equity-secured loans

How to apply: Fill out a quick online form. Co-signers may be added to improve approval chances.

Example: A newly hired applicant applied for a $15,000 loan to pay off credit cards and was approved with flexible monthly payments.

5. CIBC (Canadian Imperial Bank of Commerce)

Loan amount: $3,000 – $200,000

Best for: Applicants with strong credit and steady income

Rate options: Fixed or variable; collateral may improve rates

How to apply: Apply online or visit a branch. Provide ID, income verification (e.g. T4), and recent bank statements.

6. Innovation Credit Union

Loan amount: $5,000 – $50,000

Coverage: Available in most provinces except Quebec

Specialty: Budget-based customized loan terms

How to apply: Apply online, pay a $5 membership fee, and provide SIN and basic personal info.

7. Fairstone Financial

Loan amount: $500 – $60,000

Founded: 1923, with over 230 branches

Options: Secured and unsecured loans available

How to apply: Apply online or in-branch. Secured loans require home appraisal; unsecured loans are faster.

8. easyfinancial

Loan amount: $500 – $100,000

History: Over 30 years in operation, with 400+ branches

Speed: Approval in as little as 10 minutes; same-day disbursement

How to apply: Apply online or visit a local branch. Co-borrowers may receive a 2% interest rate reduction.

9. Fat Cat Loans

Loan amount: $300 – $50,000

Platform type: Aggregator that works with various lenders

Highlights: High approval odds, simple application process

How to apply: Submit one form online to receive matched loan offers based on financial profile.

Personal Loan Market Trends in Canada

As of 2025, personal loan interest rates in Canada are legally capped at 35% APR. This regulation protects borrowers, especially those with less-than-perfect credit. The most competitive rates for prime borrowers can be as low as 6.99%.

Top Picks for Fast Loans

For urgent needs, the fastest loan providers include:

Spring Financial: Same-day decisions and transfers

easyfinancial: Instant approval in 10 minutes and fast funding

How to Choose the Right Lender

Before applying, consider the following steps:

1. Check Your Credit Score

Understanding your score helps identify likely approval scenarios. Request a report from Equifax or TransUnion, or use fintech platforms like Borrowell or Nyble for ongoing credit monitoring.

2. Choose the Right Loan Type

Secured vs Unsecured Loans

Fixed vs Variable Rates

Individual vs Co-signed Applications

Loan type influences interest rates, approval, and repayment flexibility.

3. Compare Lending Channels

Banks and Credit Unions

Banks and credit unions primarily serve borrowers with good to excellent credit scores. They typically offer lower interest rates and more favorable loan terms. However, the approval process tends to be more complex and slower, requiring borrowers to prepare extensive documentation and wait longer for loan approval.

Peer-to-Peer (P2P) Lending Platforms

P2P lending platforms are suitable for borrowers with good credit who prefer a fast, digital loan application process. These platforms generally have lower operating costs, allowing them to offer competitive interest rates. The entire application process is conducted online, making it convenient and quick.

Alternative Lenders

Alternative lenders are better suited for borrowers with fair to poor credit. These lenders have more flexible approval criteria and typically charge higher interest rates. However, they offer faster approval times and mostly support online applications, meeting the urgent funding needs of borrowers.

How to Avoid Loan Scams

To ensure you're dealing with a legal lender:

Look for proper business registration and office address

Verify privacy policy, terms and conditions

Check for reviews and presence on trusted platforms

Avoid lenders with hidden fees or aggressive sales tactics

Application Process Summary

Fill out a loan application with personal and financial details

Receive pre-approval decision (varies by lender)

Submit supporting documents (bank statements, ID, income proof)

Review final offer and repayment terms

Sign the agreement and receive funds via Interac or direct deposit

Frequently Asked Questions

What is considered a good credit score in Canada?

A score of 660 or higher is generally considered good and helps secure lower interest rates.

Can I still get a loan with a low credit score?

Yes, many alternative lenders accept lower scores, though interest rates may be higher.

What is a reasonable loan interest rate?

Depends on your financial profile. Borrowers with excellent credit may get offers close to the

prime rate (currently ~4.95%), while others may face higher rates.

Conclusion

In 2025, Canada’s personal loan market offers improved flexibility, faster approvals, and diverse product choices. Whether seeking emergency funds, planning major expenses, or consolidating debt, borrowers can compare institutions and find a loan aligned with their financial capacity and repayment goals.

Key considerations include interest rate, loan term, approval speed, and provider transparency. Responsible borrowing and informed decision-making remain the foundation of healthy financial management.